Heck Capital’s team of investment professionals conducts in-house investment research, from macroeconomic evaluation to security selection and portfolio construction. The team of investment and research analysts, portfolio managers, and Investment Committee members continuously evaluates all types of investment options across many asset classes, including individual equities and bonds, Exchange Traded Funds (ETFs), Mutual Funds, Alternatives, and Collective Investment Trusts (CITs).

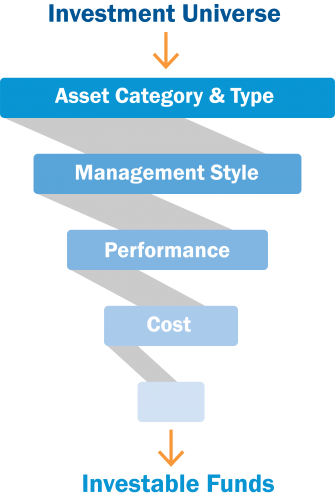

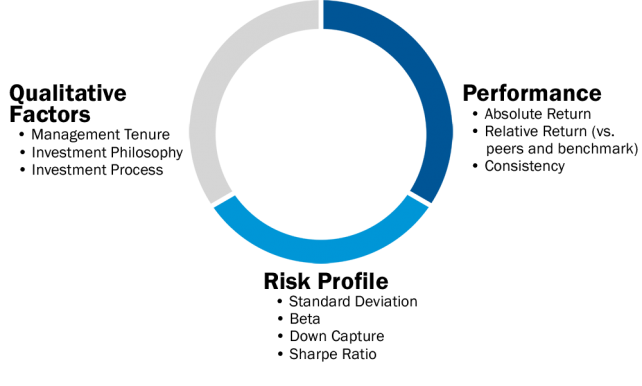

In conducting mutual fund and third party manager evaluation, our investment professionals utilize a proprietary methodology to conduct a screening process to help identify mutual funds and managers amongst the hundreds of thousands of investment options spanning 50+ traditional and alternative asset classes to compare available investment options across the market today. Our proprietary screening and scoring process examines investment managers in specific asset classes relative to their peers based on a wide range of quantitative and qualitative factors in order to identify consistent, cost effective investment options within a specific asset class.

The asset allocation process is an ongoing review and assessment of the current macro and micro economic environment. We combine this research with additional fundamental, asset class, regional and sector based research in order to understand the broad backdrop of the global economy. From there we implement our viewpoints based on the investment strategies’ internal guidelines. Each investment strategy seeks to meet different objectives and outcomes or provide different levels of risk.

Managers Screened

12,800+

Total Funds Screened

210,400+

Here’s how we begin our research process:

-

Mutual Fund and ETF Filtering

-

After filtering out the top mutual funds and exchange traded funds, we perform a thorough analysis of quantitative and qualitative data to select and monitor top ranked managers for consistency, tenure, rankings vs. the index and peer-group, and risk / return comparisons.

-

Scoring Process

-

Mutual funds and ETFs are reviewed in traditional and alternative asset classes, while active and passive investment strategies are scrutinized for distinct and competitive advantages. Based on our filtering and scoring criteria, we select appropriate funds in each category.

After identifying the top funds from the investment universe using our proprietary filter and scoring system, we provide our research recommendations to our institutional clients. These recommendations are made with consideration to the Plan’s Investment Policy Statement, current and future income needs, Plan structure, and objectives. We believe in our process and we provide our research and reporting services to multiple successful institutions across the country.